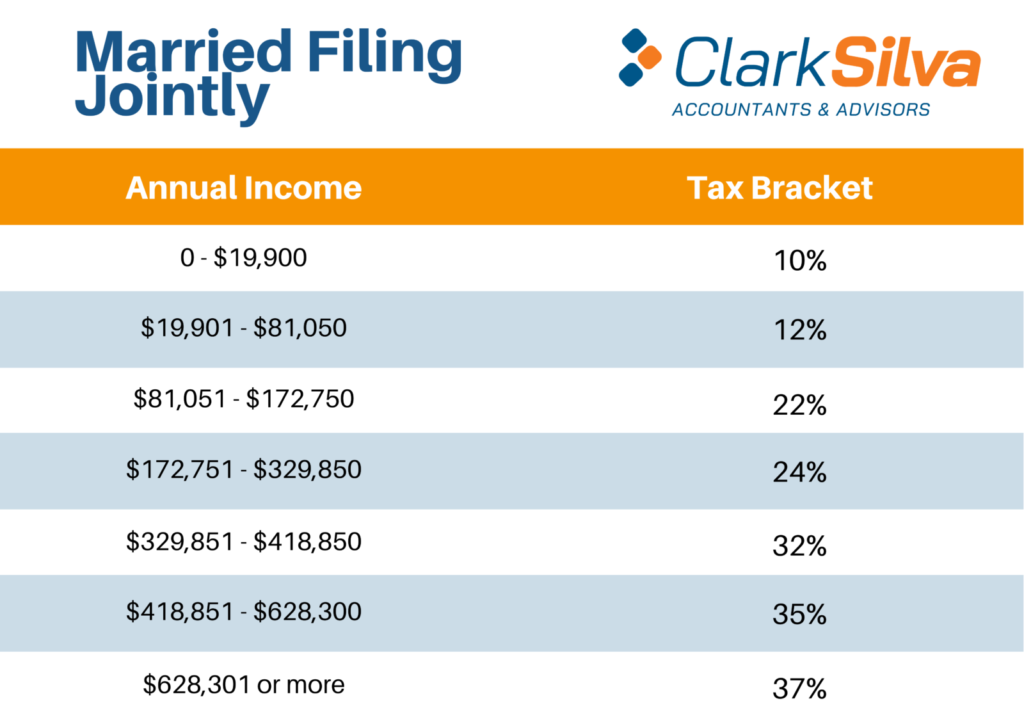

The Canada Revenue Agency has previously attempted to challenge surplus strip transactions, but the courts have generally held that this type of planning is acceptable, and doesn’t violate the general anti-avoidance rule, since the Income Tax Act doesn’t contain a general policy requiring shareholders to remove their surplus via a dividend rather than a capital gain. The government may decide to shut down a popular private corporation tax-planning arrangement that some sophisticated taxpayers have been employing to distribute corporate surplus (essentially, retained earnings for tax purposes) from their corporation at capital gains rates, rather than at the higher rates for Canadian dividends, or via the payment of a salary or bonus. He called for a top federal income tax rate of 39.6 per cent, up from 37 per cent, for taxpayers earning more than US$400,000. If enacted, this could bring the top combined marginal tax rate, once provincial tax is factored in, to approximately 56 per cent in British Columbia, Ontario, Quebec and Nova Scotia, and to 57 per cent in Newfoundland and Labrador.Ī similar proposal to bump up the top rate for the highest income earners was recently included in United States President Joe Biden’s budget announcement earlier this month. The NDP’s pre-election platform hoped to increase the top rate by two percentage points to 35 per cent. The top federal tax rate of 33 per cent currently kicks in at an income of more than $235,6, which is a 6.3 per cent bump in the threshold over 2022 as a result of the high inflation we’ve been experiencing over the past year. With that ominous theme in mind, here are some potential tax changes that could target higher-income Canadians, along with some potential planning tips.

No one knows with any certainty what will be in the upcoming budget, but we can glean some insight on its potential themes from the 226-page pre-budget Report of the Standing Committee on Finance issued last week, which contained 230 separate recommendations for tax changes and spending.Īmong the proposals, the following recommendation may set the tone: “Undertake a public review to identify federal tax expenditures, tax loopholes and other tax avoidance mechanisms that particularly benefit high-income individuals, wealthy individuals and large corporations and make recommendations to eliminate or limit them.” Finance Minister Chrystia Freeland will deliver Canada’s federal budget plan on March 28, giving us less than two weeks to speculate about what may - or may not - be included therein, which also means time is running out to do any significant planning before any potential tax changes. Canada's Finance Minister Chrystia Freeland holds a news conference before delivering the 2022-23 budget, in Ottawa

0 kommentar(er)

0 kommentar(er)